Welcome to the Free edition of How They Make Money. Over 250,000 subscribers turn to us for business and investment insights. In case you missed it: 🥽 Metaverse Reality CheckZuck is finally listening. After burning nearly $70 billion on Reality Labs since 2021, Meta is reportedly preparing to slash its Metaverse budget by up to 30%. The stock jumped on the news. Wall Street sees this as a signal of discipline and focus. Call it the “Year of Efficiency” part deux. Reality Labs’ losses have been an overhang for years, while the core “Family of Apps” business has been thriving. Horizon on the chopping blockThe company isn’t exiting hardware altogether. Instead, it is a surgical strike on the software that powers the Metaverse vision.

Meta spent billions on a platform war that no one else showed up to fight. With adoption still stuck in the gaming niche and rivals like Apple and Google pivoting entirely to AI and Spatial Computing, the “existential threat” has vanished. Zuck is realizing he is effectively racing against himself, which means he has the luxury to slow down. To be sure, Zuck still has hardware on his mind. He just poached Alan Dye, Apple’s longtime VP of Human Interface Design, who will lead a new Creative Studio at Reality Labs. Dye led the design for the Apple Watch and Vision Pro interfaces. His move suggests Meta is now serious about building hardware that people actually want to wear.

From “Metaverse First” to “AI First”Reality Labs has been described as a “leaky bucket” by analysts. By capping the Metaverse spend, Zuckerberg can reallocate capital to the real war: Generative AI and Smart Glasses (the hardware that actually has traction). If you recall, Meta and EssilorLuxottica have sold over 2 million pairs of Ray-Ban Meta AI since their launch in October 2023. The company is on track to raise production to 10 million units per year by the end of 2026 to meet demand. Zuck has already dropped hints that the “Family of Apps vs. Reality Labs” reporting structure is becoming obsolete.

Expect a potential re-segmentation in FY26 that blurs these lines—and conveniently hides the standalone “Metaverse” losses inside a broader “AI Infrastructure” cost center.

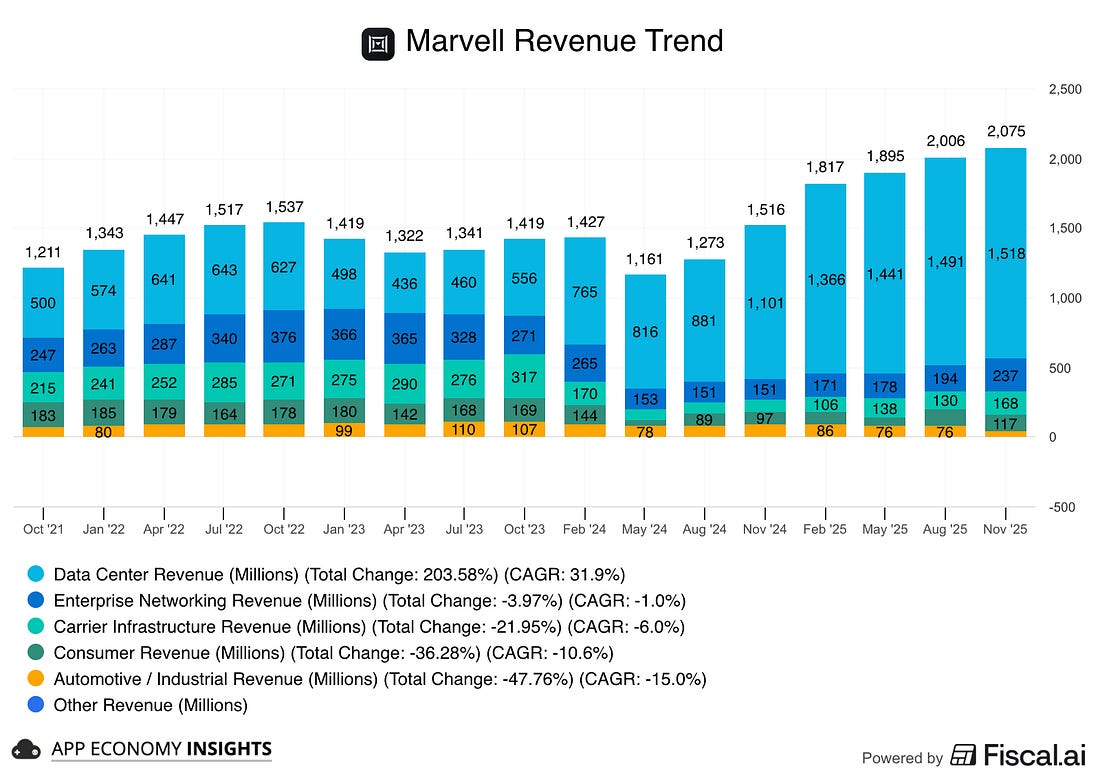

📶 Marvell & The Nervous System of AIMarvell’s Q3 FY26 (October quarter) was all about the pivot to AI infrastructure. The company has effectively transformed from a cyclical semiconductor maker into a pure-play AI bet. You might notice a massive $1.9 billion windfall in “other income” in the top right. This is a one-time gain from the sale of Marvell’s Automotive Ethernet business to Infineon during the quarter. While it boosted the bottom line significantly, it is a non-recurring event, which also explains why the Automotive/Industrial revenue segment dropped sharply year-over-year. Overall revenue rose 37% Y/Y to $2.1 billion ($10 million beat), and non-GAAP EPS jumped 77% Y/Y to $0.76 ($0.02 beat). Data Center revenue surged 38% to $1.52 billion, accounting for 73% of total revenue. While Enterprise and Carrier rebounded, it was from a very low base. In just two years, Data Center revenue has nearly tripled from ~$500 million to ~$1.5 billion, effectively offsetting the cyclical decline in the other segments

Margins improved dramatically following a restructuring last year, and operating cash flow improved 9% Y/Y to $582 million. Management leaned into capital returns with $1.3 billion of buybacks plus dividends. Celestial AI: Buying the Photonic FutureThe headline move is the $3.25 billion acquisition of Celestial AI.

Deal Structure:

Multi-year AI roadmapThe near-term guide was in line, but the multi-year outlook moved the stock.

Why the confidence? Custom silicon remains the core engine. Marvell expects sales to grow ~20% next year with no “air pockets.” Analysts now see stronger visibility into programs tied to Amazon’s Trainium, Microsoft’s Maia, and a new win with an “emerging hyperscaler.”

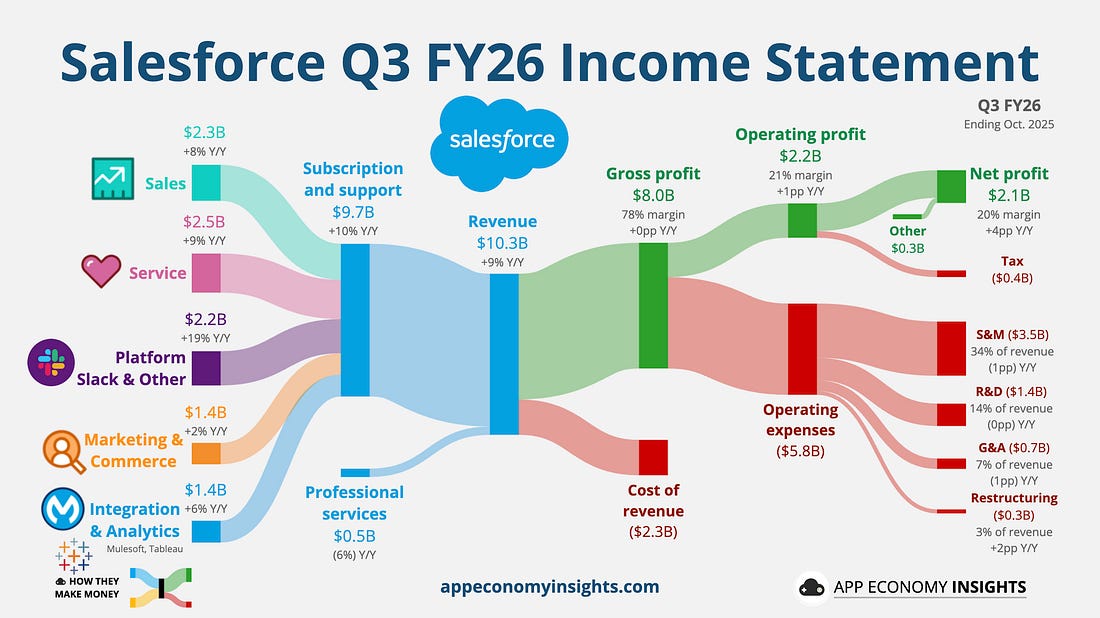

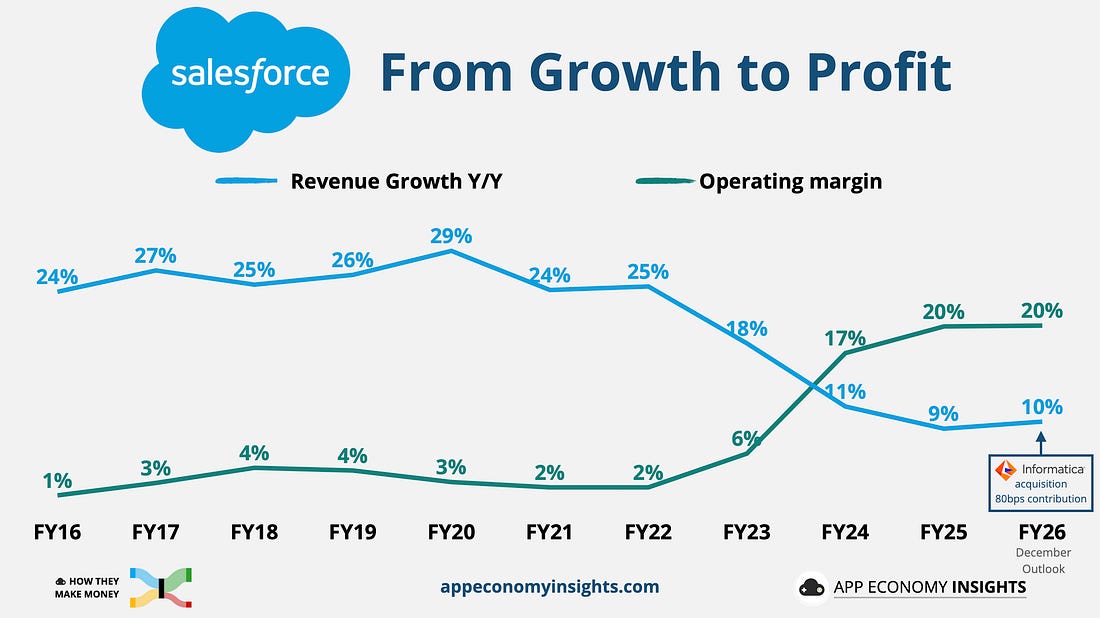

☁️ Salesforce: The Agentic AwakeningSalesforce posted a solid but unspectacular quarter on the surface, but under the hood, the engine is shifting gears. Revenue grew 9% Y/Y to $10.3 billion (in-line), and non-GAAP EPS landed at $3.25 ($0.39 beat). The margin expansion story continued, with the operating margin improving to 21% (+1pp Y/Y). Importantly, the business remains a cash machine, with free cash flow growing 22% to $2.2 billion. Agentforce: Validating the hypeThe real story this quarter is the definitive pivot from experimentation to paid production. Marc Benioff called Agentforce and Data 360 the “momentum drivers,” and the paid deal velocity backs him up. The combined ARR for these products hit ~$1.4 billion, more than doubling year-over-year (+114%). Agentforce alone has surged to a $540 million run-rate, growing an explosive 330% Y/Y. Of course, that’s a tiny piece of Salesforce’s ~$41 billion revenue expected in FY26, but the momentum is critical here.

This is the “Agentic Enterprise” in action: moving from sidecar chatbots to autonomous agents embedded directly into sales and service workflows. Crucially, half of these bookings came from existing customers expanding their footprint, a classic signal of platform durability. Benioff used the call to dismantle the “DIY AI” narrative, noting that companies trying to build their own agents (like Klarna in late 2024) are hitting a wall on security and governance—driving them back to software platforms. The data foundationSalesforce is quietly solving the last-mile problem of AI: getting clean, harmonized data into agentic workflows. The acquisition of Informatica (closed ahead of schedule in November), combined with Data 360, creates a data layer that management expects to become a $10 billion business next year. The goal is to ingest tens of trillions of records to power low-hallucination agents across verticals like Life Sciences and Public Sector. The path to re-accelerationManagement nudged the full-year outlook higher, but that was all due to Informatica closing earlier than expected, contributing roughly $330 million.

Current RPO is expected to accelerate to ~13% growth in constant currency in Q4 (boosted by Informatica), and remains the best indicator for future revenue growth. While organic growth is still single digits (~9%), management explicitly signaled a 12–18 month path to re-acceleration as Agentforce scales and the data stack fully integrates.

That’s it for today. Happy investing! Want to sponsor this newsletter? Get in touch here.Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link. Disclosure: I own CRM and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members. I would love to hear your feedback! Reply to this email to reach out to me with questions or suggestions. If you enjoyed today's newsletter, please share it with your friends and family! You’ll earn rewards if they subscribe. You’re a free subscriber to How They Make Money. For the full experience, become a Premium subscriber. |

0 💬:

Post a Comment