Ben Affleck, AI, and the $83 billion defensive moat

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

| | |

| Welcome to the Premium edition of How They Make Money. Over 270,000 subscribers turn to us for business and investment insights. In case you missed it:

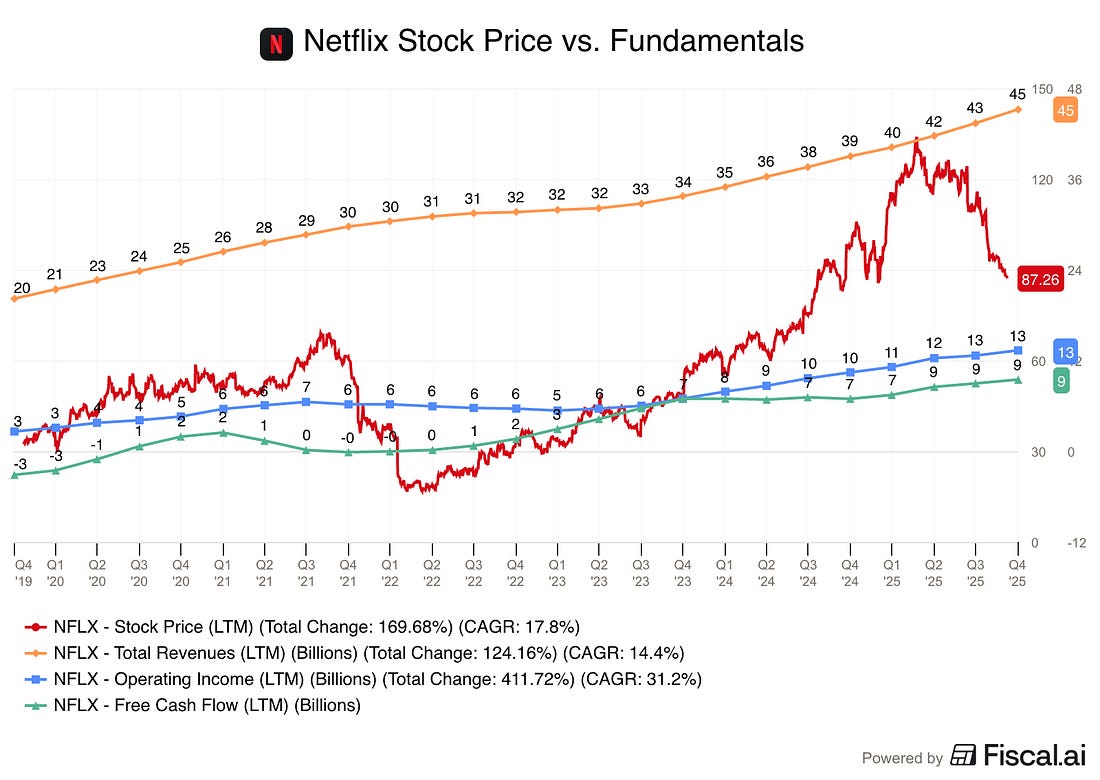

Netflix shares are trading 37% off their June 2025 peak. That’s the largest downturn for the stock since its 75% collapse in 2022. But the drivers are very different. In 2022, investors fled due to slower growth post-COVID. Today, the sell-off is a two-part drama: Profitability scare: Netflix shares stumbled after a Q3 earnings miss, driven by unexpected margin compression and a messy ~$600 million tax dispute in Brazil. Merger shock: That caution turned into a full-blown exit in December. The pending $83 billion Warner Bros. acquisition introduced complexity, a massive debt load, and integration risks.

All eyes are on the ongoing drama surrounding the merger, with a hostile takeover from Paramount/Skydance and new moving pieces (more on this in a minute). Today at a glance: Netflix Q4 FY25. Warner Drama Update. Key Earnings Call Quotes. Ben Affleck vs. The Bitter Lesson.

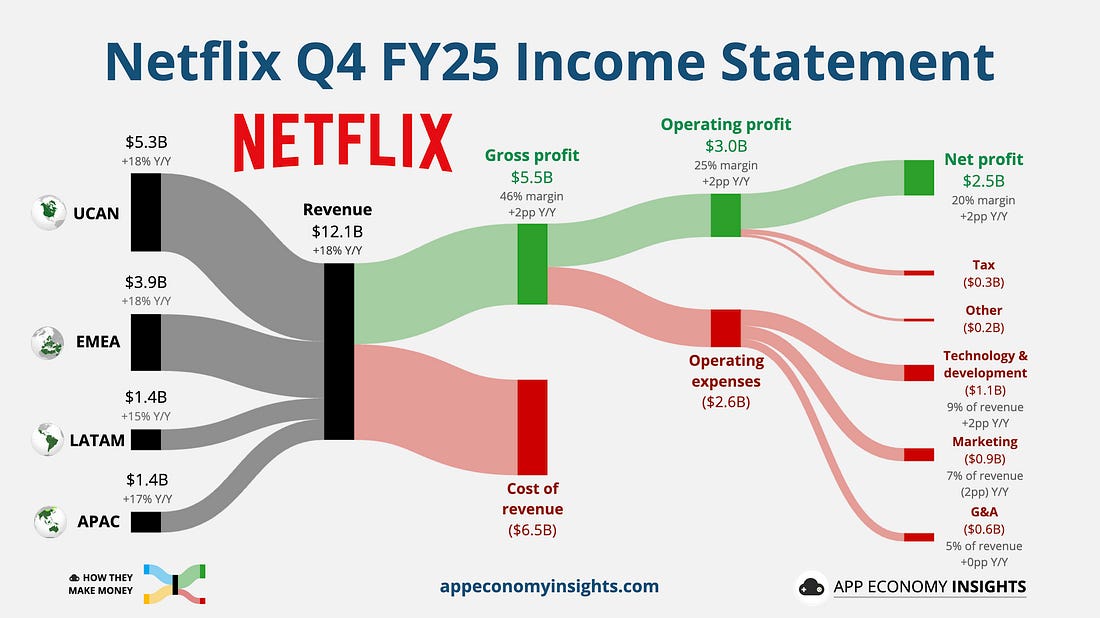

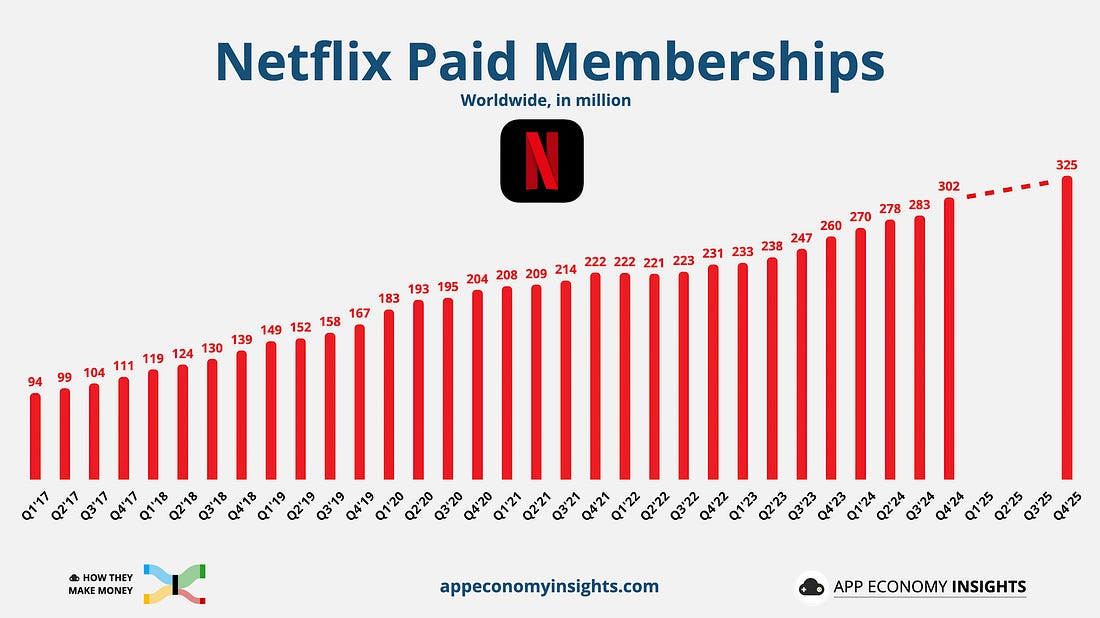

📈 Growth accelerates: Revenue growth re-accelerated to +18%, fueled by the ad tier. After stopping regular subscriber updates in 2025, Netflix revealed a new milestone of 325 million paid memberships (representing 8% subscriber growth) and now serves an audience approaching 1 billion people globally.

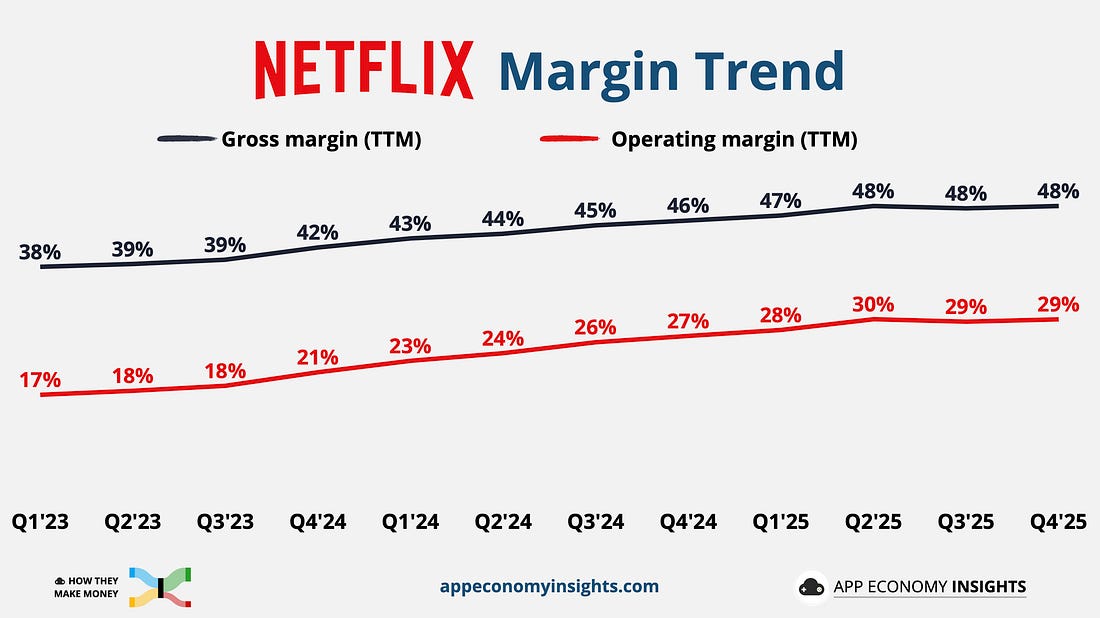

📢 Ads scale up: The ad business is becoming material, with revenue growing 2.5x Y/Y to $1.5 billion in FY25 (3% of overall revenue). Management noted the ad-supported plan now accounts for over 50% of new sign-ups in available markets, validating the multi-tier strategy. Management expects ad sales to double to ~$3 billion in 2026. ⚠️ Engagement slowing: This is the bearish signal. Despite a massive $18 billion content spend in 2025 (up 11% Y/Y), engagement grew only ~2% in the second half. Management plans to hike spending by another 10% in 2026. 📊 Margins follow seasonality: Operating margin landed at 25%, down sequentially from Q3 (28%) but up +2pp year-over-year. The sequential dip was expected, reflecting the heavy Q4 content slate and marketing push during the holidays. The year-over-year expansion demonstrates continued operating leverage, validating that the margin compression in Q3 was indeed a one-off.

🌍 Sony Pictures deal: A new global exclusive partnership grants Netflix first-window streaming rights for major theatrical releases, including The Legend of Zelda and the Spider-Verse finale, through 2029. Netflix wants to be the inevitable home for Hollywood’s biggest hits immediately after they leave theaters. 🔮 FY26 guidance is noisy: Revenue is expected to rise ~13% Y/Y, with margins expanding, and FCF growing ~16% Y/Y to $11 billion. That said, some costs will be front-loaded, and the Q1 EPS guide fell short of estimates, adding near-term pressure. The focus now shifts to integration, execution, and regulatory approval for the mega-merger. 🏦 Leverage focus: To fund the Warner Bros. deal, Netflix secured $42.2 billion in bridge financing. While the balance sheet currently shows $14.5 billion in debt, this load will increase significantly. Share buybacks are paused indefinitely to hoard cash for the purchase. All eyes will be on the deleveraging path and synergies expected.

In our deep dive in December, we analyzed Netflix’s proposed merger with Warner Bros. We warned then that it was far from a done deal. Six weeks later, the mega M&A move has turned into a trench war on three fronts. Here’s the state of play as of today and what to make of it... Subscribe to How They Make Money to unlock the rest.Become a paying subscriber of How They Make Money to get access to this post and other subscriber-only content. A subscription gets you: | 2 articles per week plus access to our archive |  | Monthly high-resolution rollups with earnings visuals |  | Monthly industry breakdowns covering leading players and the key industry trends |

| |

0 💬:

Post a Comment